The browser you are using is not supported. Please consider using a modern browser.

When Is the Right Time to Talk to Your Borrower About Their Credit?

Professional loan officers succeed because they know when to approach their borrower with different kinds of information, field requests and make sure not to overwhelm them with the hundreds of things that need to be done during the homebuying process. For example, trying to explain the closing process before the application is complete can be counterproductive and confusing.

In our discussions with professional loan officers across the country, we have found that the best LOs know the importance of helping their loan applicants understand and manage their credit scores. They know what an impact a good score can have on their ability to help their applicant qualify for a loan.

For Homeseekers who have a lot of work to do to repair their credit, these LOs begin that conversation well in advance of the application. In most cases, that work must begin even before they start searching for a home to buy. These consumers could benefit from a CreditXpert custom credit action plan, which could show them a path to a higher credit score in as little as 30 days.

For other consumers, some loan officers wait until credit becomes a problem to have the discussion with their applicants. This is usually after the application is complete when the applicant finds out that the low interest rate advertised isn’t available to them.

That’s waiting too long.

When do consumers want to have the credit conversation?

Recently, we contracted with a consumer research firm to speak to consumers about a range of issues related to their credit, their home buying journey and their willingness to take action to change their current situation.

What we learned is what most LOs already know: consumers have a lot of bad information about their credit scores and a lot of questions. They don’t know where to go for good information, information the LO already has.

In a previous post, we wrote about the emotional benefits that come from having the credit conversation with loan applicants. They are significant. This strategy allows lenders to win on price while winning hearts.

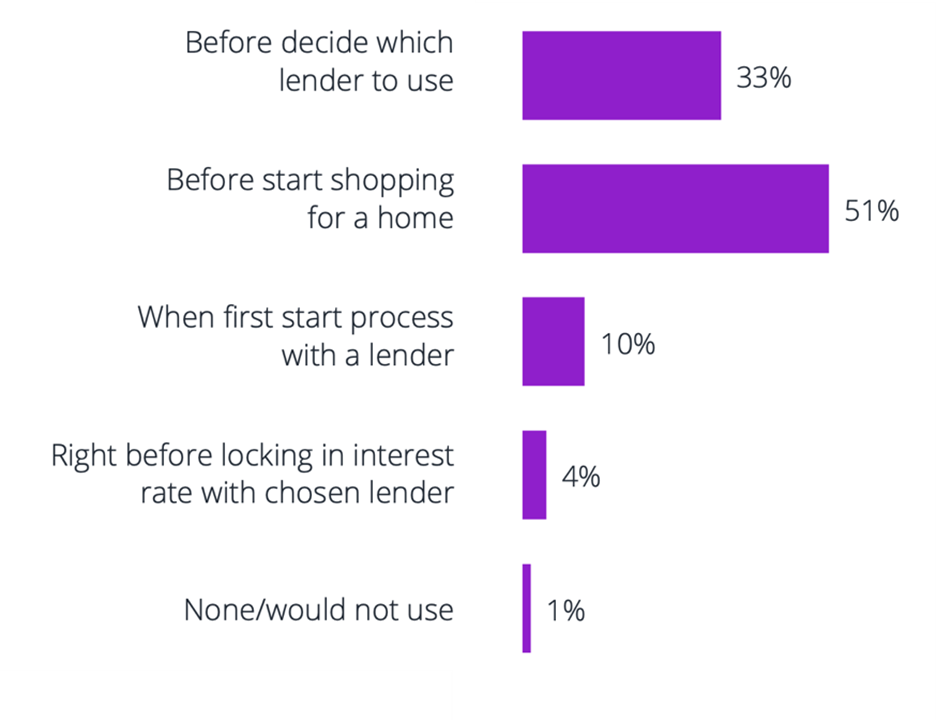

But how early in the loan origination process should that conversation take place? We asked consumers this question in our recent outreach. Here’s what they told us.

Consumers know they need to understand their credit. More than half of them will start trying to find information about it before they start shopping for a home. That means the LO can’t have this conversation early enough. Because the applicant is likely still working with their real estate agent at this point, it makes great sense for the LO to offer their business referral partners information about improving their buyer’s credit.

How long will all of this credit stuff take?

Some of the loan officers we spoke to were hesitant to bring up credit to their applicants, especially those who had already completed their loan application, because they felt it would take too long to do anything about the consumer’s credit anyway. That’s not always true. If the consumer doesn’t have a credit history and needs credit counseling, it’s going to take a long time. But those consumers aren’t actually talking to LOs yet, nor even real estate agents.

If the consumer has a credit history, but there are problems that will take time to fix, the applicant needs credit repair and that can also take some time. Many LOs work with these borrowers in the knowledge that they are building a pipeline of far future business.

But the consumer is a near miss due to credit or wishes they could qualify for a better deal on their next loan, these are problems that can potentially be solved within 30 days or so, during the loan origination process. This is not credit counseling or credit repair. It’s CreditXpert.

Will it work for everyone? No, but since 71% of all applicants could improve their credit by at least one 20-point bucket in about 30 days, it will work for a lot of them. If you want to know more, and you need to, get our free monthly Mortgage Credit Potential Index (MCPI) report available on our website. Knowing that 71% of applicants can improve their credit score is good; honing in on those who can be helped the most is even better. That’s what MCPI does for the lending community.

And start talking to your applicants about their credit earlier in the process. When you take the time to educate loan applicants on how a credit score works, you are taking the mystery out of not only credit scores, but the mortgage process itself. When you offer it at the very beginning of the process, you build trust and that equates to more business.

Related Credit Insights

The enterprise-ready SaaS platform helps mortgage lenders attract more leads, make better offers and close more loans.

We're in a bit of a free fall in the market, and I think lenders are figuring out how to adjust to that. As a result, we're hearing a lot of them talking about how they plan to leverage technology like ours to be more competitive in the market. How can lenders use CreditXpert tools as a strategic growth engine?