The browser you are using is not supported. Please consider using a modern browser.

Rates, Terms and Fees Matter MOST

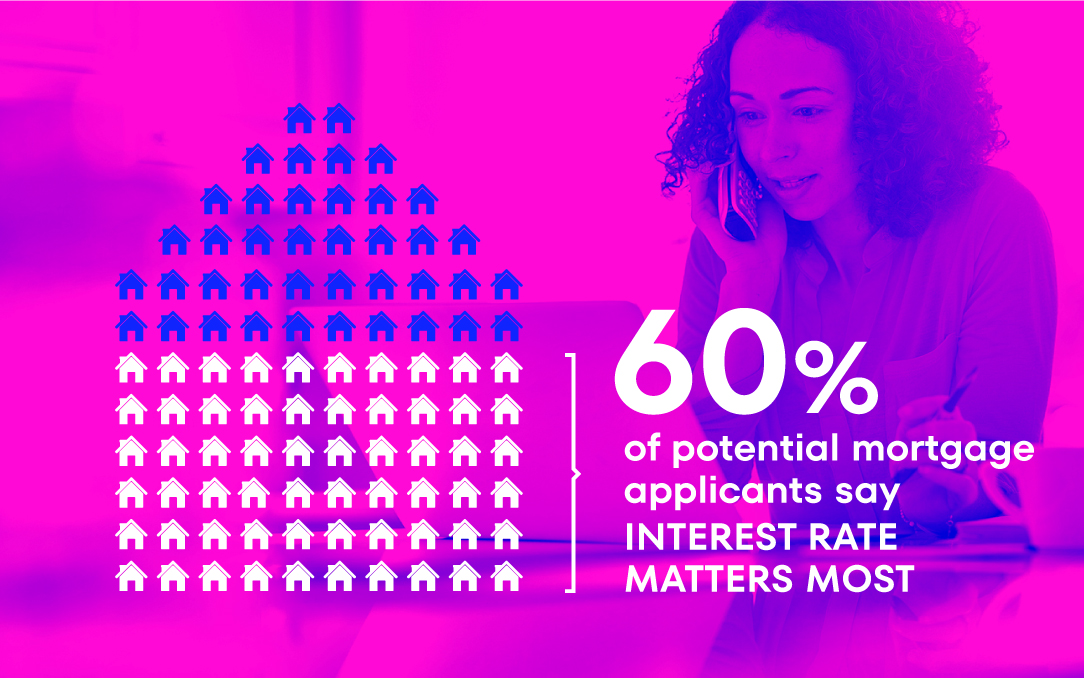

Pro Tip #3: 60% of potential mortgage applicants, according to our 2020 consumer survey, told us INTEREST RATE matters most when choosing THEIR mortgage lender. What they’re really saying: rate, fees, terms and payments must fit their budget and lifestyle.

What this means for Lenders and Lending Strategy in 2022:

Applicants are making a BUYING decision with every mortgage. It’s a big decision, often the biggest buying decision most will ever make.

‘PRICE’ matters above all else. In fact, the top two areas of interest to buyers are interest rate and monthly payment. And interest rates drive payments more than any other factor. Rate-competitive lenders land more loans.

Mortgage loans are a COMMODITY. Price drives commodity buying decisions.

Your mortgage offering must be de-commoditized as well as COMPETITIVELY PRICED.

How You Win with CreditXpert’s Credit First Strategy:

Applicants and their lenders need CERTAINTY in today’s highly competitive real estate and mortgage markets. We deliver credit score certainty, the fastest route to better financing. We provide applicants step-by-step instructions to maximize their mortgage credit score so that lenders can offer them the best possible financing options. CreditXpert has analyzed almost one billion credit reports over the past 20 years. We know what it takes, with certainty, to quickly, efficiently and affordably optimize credit scores.

‘Top of the Funnel Tips’ from CreditXpert:

LEVERAGE CXI’s tools on every loan. Higher credit scores equal more competitive rates.

COMPETITIVE rates equal more closed loans, higher productivity and higher profitability. Use CXI’s tools to ensure applicants qualify for the best possible rates and financing options.

CONTINUE the meaningful conversation about credit score improvement by demonstrating the rate impact of a higher credit score.

FOLLOW-UP on applicant’s progress and encourage them to FOLLOW-THROUGH on their credit score improvement plans. Remind them of the savings they’ll realize with a higher credit score.

Next week’s Pro-Tip explores Credit Score Information, the number three reason applicants choose THEIR lender. In the meantime learn more by downloading our Credit First eBook. Or drop us an email at getstarted@creditxpert.com. We’d appreciate the opportunity to discuss how CreditXpert helps you put Credit First to close more loans.

Related Credit Insights

More and more agents are learning that affordability is a function, in part, of the borrower’s credit score. While things like interest rates, construction costs and housing inventory are out of our control, prospective home buyers CAN do something about their credit scores.

The homebuying process can get complicated quickly, and this complexity usually starts with determining the type of mortgage you'd like to apply for. There are a number of options, and the choice you make can affect everything from the down payment requirement to what area you're allowed to buy in.