The browser you are using is not supported. Please consider using a modern browser.

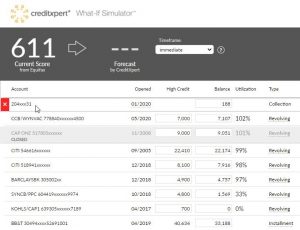

Simulating the impact of removing medical collection accounts

There is a common misconception in the mortgage industry that medical collection accounts are factored into credit scores differently than other third-party collection accounts. However, all that matters to the scoring model is whether the third-party collection account exists and when it occurred – the type of collection or balance amount aren’t factored in at all.

There is a common misconception in the mortgage industry that medical collection accounts are factored into credit scores differently than other third-party collection accounts. However, all that matters to the scoring model is whether the third-party collection account exists and when it occurred – the type of collection or balance amount aren’t factored in at all.

While newer credit scoring models such as FICO 9 treat medical collections differently – as well as remove them from being considered by the score once they are paid in full – this is not the case for the standard credit scores used in the mortgage industry. However, you may still be able to get the benefits for your borrower.

Collection companies are often willing to remove the collection accounts if your borrower 1) settles the debt and 2) asks them to delete the record. But before you ask your client to act, it’s important to first simulate removing the medical collection account with CreditXpert® What-If Simulator™ to determine the expected score impact.

Simulating the removal of a medical collection account is easy! Once you pull up your client’s information in CreditXpert What-If Simulator, all you need to do is move your cursor over the collection account in the list of reported items and click the “x” that appears in the red box on the left-hand side.

Learn more about medical collections and see a quick demo of their removal using CreditXpert What-If Simulator in our “Xpert Insights” video below:

Related Credit Insights

Do medical collection accounts impact a homebuyer’s credit score differently than other collection accounts? Get the facts from Product Support Manager Rosa Mumm in our new “Xpert Insights” video.

Sheri Kagimoto, a mortgage loan originator at Aligned Mortgage Hawaii of Waipio, Oahu, was working with a client who was eager to purchase a property.