The browser you are using is not supported. Please consider using a modern browser.

Demystifying Loan Amortization: How Mortgage Payments Repay Mortgage Loans

What is a 30-year fixed rate mortgage?

A 30-year fixed rate mortgage is a type of home loan in which the interest rate stays the same for the life of the loan, typically 30 years. A fixed rate mortgage offers stability, as the monthly payment remains the same, even if interest rates rise in the future. Like all mortgage loans, fixed rate mortgages are amortized, which means that they are paid off over time through regular payments that include both interest and principal.

How is loan amortization calculated? How does a mortgage loan work?

A loan of $325,000 with an interest rate of 6.00% is an example of a typical 30-year fixed rate mortgage. The amortization process begins with the payment of interest, which makes up the majority of the monthly payment during the early years of the loan. Interest is calculated based on the outstanding balance of the loan, so as the balance decreases, the amount of interest paid decreases over time.

This is the most important point to remember about loan amortization: more interest is paid than principal for about 60% of the 30 year life of the loan. Far more interest than principal is paid in the very early years of the loan. This is one of the many reasons, other than a lower monthly payment, that obtaining the lowest possible interest rate is of the utmost importance.

Understanding loan amortization is easy. It takes a little math that is easily done on-line with a few bits of data such as mortgage amount, interest rate, the term of the loan. In our example the data points are $325,000, 6.00% and 30 years (360 months), respectively.

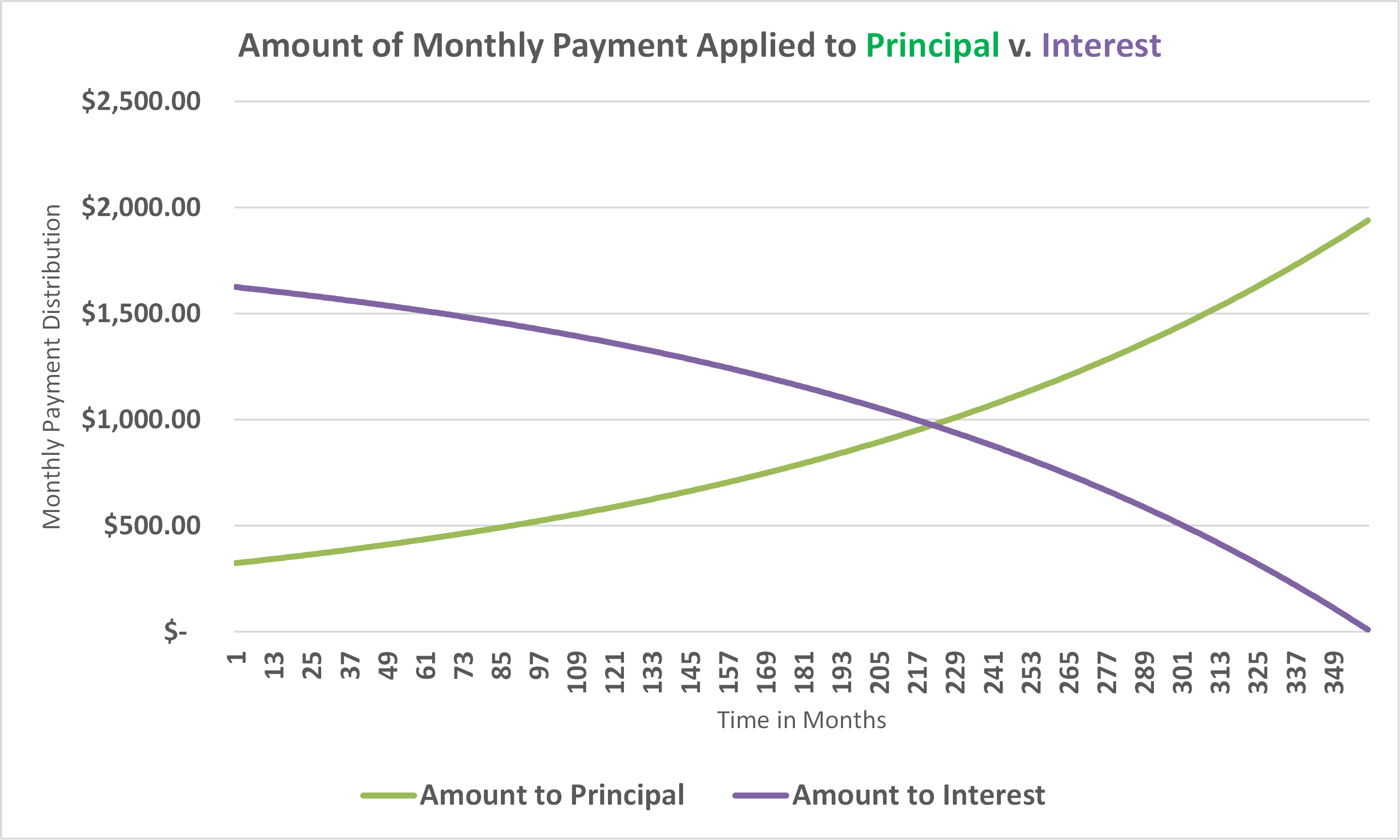

And for our example loan it is not until the 223 payment, 18.5 years into thirty-year span of the mortgage, that more principal is paid than interest. Graph I shows this clearly:

Graph I

Principal v. Interest Payments

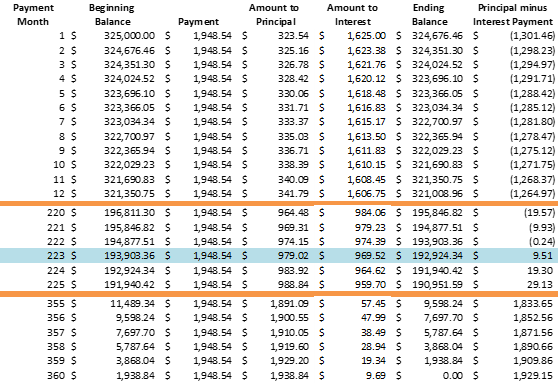

Graph I is a pictorial representation of how loan amortization. Table I is an excerpt of the actual loan amortization table for our example loan:

Table I

Loan Amortization

As the table shows, the monthly payment remains the same for the life of the loan, and the interest paid decreases over time as the balance of the loan decreases. As the green bar in month 223 shows, this is when more principal is paid than interest. By the end of the 30-year term, the entire balance of the loan will have been paid off, and the borrower will own their home outright.

How do lower interest rates make a difference in the life of your home loan?

While it’s not possible to change the mechanics of loan amortization, the math is what it is, a lower interest rate means the overall cost of the loan is lower. This matters whether you plan to keep the loan for its entire 30-year life or if you plan to refinance your home or sell your home and purchase another one in a few years. The reality is that most 30-year loans are repaid within five to seven years. Twenty-five percent of the total interest on a 30-year loan is paid during its first five years. Thirty-five percent is paid in the first seven years.

Your lender may not automatically offer you the lowest possible rate on your mortgage. Many factors are at play when a lender sets its mortgage rates. All else equal, the only variable you can influence is your credit score. Here, too, lenders may not automatically offer help or guidance when it comes to improving your credit score at the time you make application or during the mortgage process. Ask. Lenders are aware of credit score improvement – not credit repair, not credit counseling – improvement.

What they might not know is roughly 70% of all consumers who apply for a loan could improve the credit score by at least one 20 point credit band. About 50% of consumers can improve their scores by up to three 20 -point credit bands. Both improvements, 20 points or more, are often enough to improve your mortgage rate enough to lower your payment AND the total interest you’ll pay over the life of the loan.

Make sure to ask your loan officer about credit score improvement. The interest savings over the life of any mortgage loan is substantial, and could end up in your bank account rather than your lenders pocket. More homebuyer questions? Click here >>

Related Credit Insights

The enterprise-ready SaaS platform helps mortgage lenders attract more leads, make better offers and close more loans.

The homebuying process can get complicated quickly, and this complexity usually starts with determining the type of mortgage you'd like to apply for. There are a number of options, and the choice you make can affect everything from the down payment requirement to what area you're allowed to buy in.