The browser you are using is not supported. Please consider using a modern browser.

Best Hedge Against Rising Rates? A Better Credit Score

We’ve all seen the news over the past few months about the universal, growing problem of housing affordability. With interest rates rising, a lack of inventory and rising construction costs, fewer Americans are finding homes they can afford. According to Reuters, housing affordability is the lowest it’s been since 2008.

This is not particularly good news for mortgage lenders, but it could be worse. Currently, there are more buyers than sellers and we continue to see that credit inquiries are outpacing applications. Said another way, the desire to own a home remains strong, very strong. Yet affordability presents the latest, significant barrier to today’s would-be buyers, especially those in the market for the first-time.

This is not particularly good news for mortgage lenders, but it could be worse. Currently, there are more buyers than sellers and we continue to see that credit inquiries are outpacing applications. Said another way, the desire to own a home remains strong, very strong. Yet affordability presents the latest, significant barrier to today’s would-be buyers, especially those in the market for the first-time.

While it’s important to keep in mind that interest rates are still at historic lows, affordability is, in the short run, starting to impact both home buyers and real estate agents. Professional agents build relationships with people in their communities and then stand ready to step in and support them when they are ready to buy or sell a home. If the prospective buyers in an agent’s database can’t afford the homes in the agent’s community, the agent’s ability to serve their clients will suffer.

Fortunately, more agents are learning that affordability is a function, in part, of the borrower’s credit score. While things like interest rates, construction costs and housing inventory are out of our control, prospective home buyers CAN do something about their credit scores. And quickly, too. An applicant can often better their credit score by at least one 20-point credit band with a few actions that take 30 days or less. The applicant can take the necessary steps within the normal mortgage origination cycle. Bettering credit scores does not add time to the process, it improves the position of the applicant, their realtor and their lender.

Will it make a difference? You bet.

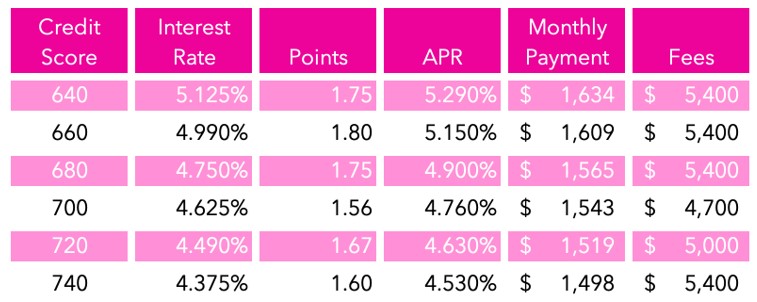

In a recent fact sheet published by CreditXpert, we analyzed the impact a borrower’s credit score would have on the pricing of a 30-year, fixed-rate mortgage for $300,000 on a home valued at $375,000. While the score doesn’t have much of an impact on lender fees, a small change in the borrower’s score can mean a big difference in interest rate and monthly payment.

The Impact of Credit Scores on Monthly Payments1

Credit Scores, Mortgage Rates, Fees and Payments[1]

A few interesting points here. First, bettering credit scores is for every applicant, not just home buyers at the lower end of the credit spectrum. More than 70% of all potential mortgage consumers can better their scores. Sadly, most are not given the opportunity.

Back to the scores, rates, fees and payments table. There is an appreciable difference between the deal offered to someone with a 700 score versus the deal offered to an applicant with a score of 740. And bettering a score by 40 points is in reach for most. In fact, more than 50% of applicants that originally score 700 could better their score by at least 40 points in less than 30 days. That means that 50% of all applicants with an initial score of 700 would potentially qualify for a mortgage rate 25 basis points lower if they and their lender took the time to review their credit score and its potential for betterment.

For mortgage lenders, it’s important to note that it doesn’t take much of a difference to win business in a competitive market. From research CreditXpert conducted with recent mortgage holders, we know that rate is the number one thing that prospective home buyers will use when picking their lender. While you may be thinking that saving $50 on a monthly payment is insignificant, think again. Our study also showed that more than 50% of consumers will apply with 3 or more lenders. They do this to shop rates and payments. When affordability is the main barrier to homeownership, and it is in 2022, every basis point in rate and every dollar in payment matters. That is how competitive this market is.

Big Data Matters

While credit scores can be a highly effective hedge against a rising rate environment, doing what is needed to reach a target score may seem like an opaque task for many. Fortunately, big data and sophisticated, validated algorithms can help chart that path. For more than 20 years, CreditXpert has been helping mortgage lenders identify the credit potential of every applicant, detailing the precise steps needed to get there. If you are a mortgage lender, make sure you have access to CreditXpert. If you are either a real estate agent or an aspiring home buyer, make sure you are working with a CreditXpert lender.

If you are a mortgage lender, let realtors in your area know you’re a CreditXpert lender and that your origination team knows how to work with applicants to better their credit scores. As you look to deepen relationships with local realtors, make sure you highlight CreditXpert as one of your differentiators.

See where the credit potential lies with your applicants >>

Learn how to access CreditXpert >>

[1] The fees listed here are those commonly found on the Loan Estimate and may include origination fees and other lender charges, third-party closing costs, taxes and other government fees and prepaid expenses and deposits. Points are a percentage of the loan amount. In this example 1.75 points equals $5,250 ($300,000*1.75). Credit score, rate and fee comparisons were made using with a commonly used calculator on forbes.com. The table is for illustration purposes only and it is important to note that individual lenders may price differently.

Related Credit Insights

The enterprise-ready SaaS platform helps mortgage lenders attract more leads, make better offers and close more loans.

Uncommon knowledge: Mortgage and consumer credit scores are quite different. What's different? How are each calculated? Why are there two scores?