The browser you are using is not supported. Please consider using a modern browser.

You're going to LOVE the new CreditXpert.

Upgrade by October 1, 2024, so you don't lose access to Wayfinder and What-If Simulator.

Why do I need to upgrade?

Better credit optimization starts here.

Wayfinder and What-If Simulator are currently sold through credit report providers. After October 1, 2024, you will no longer be able to access or purchase CreditXpert through your credit report provider. The new CreditXpert is only available from CreditXpert but will still be connected to your credit report provider. This means that you can continue purchasing credit as you do today but you will have access to an even more powerful credit optimization tool with innovative updates coming regularly.

What do I have to do to upgrade?

We've made it easy! No complicated integrations. No data migrations.

We’ve worked hard to make the upgrade process straight forward and easy. It all starts here with you telling us a little about your business. From there, we’ll get you to a channel that reflects the needs of your business. For some, you’ll be up and running on the New CreditXpert in as little as 3 – 5 business days.

How can I learn more about the New CreditXpert?

Register for a demo today!

We’ve been hard at work building out new capabilities that will make optimizing your borrower’s credit score quick and easy. You can learn more here and check out the FAQs below, but the best way to experience the power of the New CreditXpert is through one of our weekly Demo Webinars. Register here and see for yourself!

Frequently Asked Questions

-

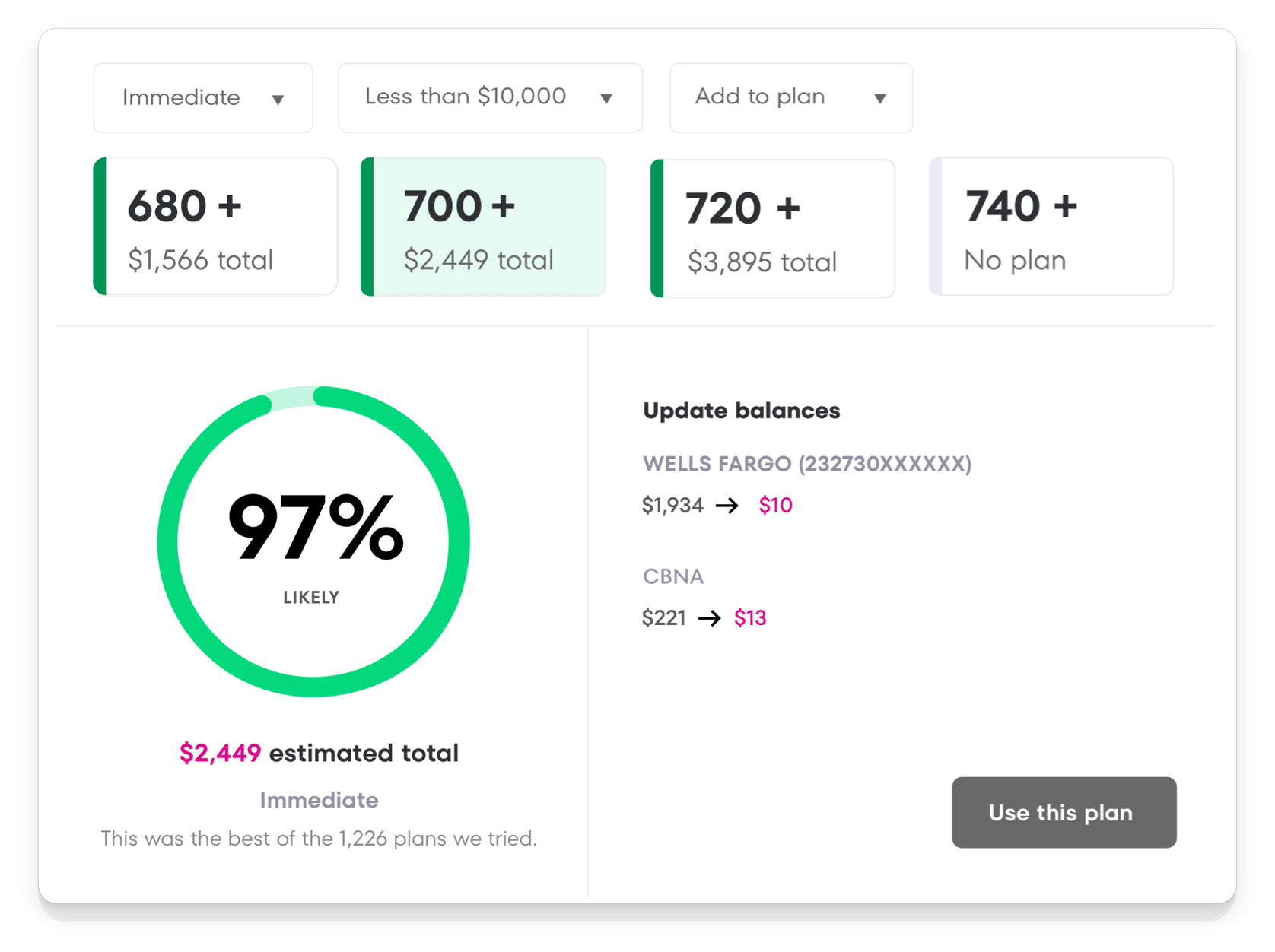

Where to start . . . To begin with, we are committed to making homeownership more accessible and affordable for ALL. This commitment is rooted in the fact that a borrower’s credit is the number one way for lenders to help them to achieve that goal at the point of origination. Knowing that 74% of borrowers with an initial score below 780 can improve their score by AT LEAST 20-points within a 30-day timeframe, we knew we needed to make it easier for lenders to identify a borrower’s potential, generate precise data-driven plans and track a borrower’s progress.

The new CreditXpert platform allows lenders and originators of all sizes to easily scale credit optimization across their organization. Whether you are a broker that is new to the industry, a regional bank, a credit union or a leading independent mortgage bank with a dedicated credit team, the new CreditXpert platform will allow you to offer credit optimization to EVERY borrower.

-

Today we offer tools (Credit Assure, Wayfinder and What-if Simulator) through every reseller. These tools certainly get the job done and are relied on by tens of thousands mortgage professionals each year. While the tools rely on the same core proprietary predictive analytics engine, they operate independently of each other. This can present a challenge to those wanting to truly scale credit optimization across their organization.

The new CreditXpert brings the best of our current tools together into an integrated, cloud-based platform. Bringing everything together into a single platform helps create a seamless and efficient flow that starts at the moment credit is pulled. We’ve also added a way to share plans with borrowers through a secure portal, track plan completion in real time and dynamic management dashboards that deliver meaningful credit insights. And with the entire platform living in a secure cloud environment, updates and innovations will be pushed to every user the moment they become available.

-

The current CreditXpert tools will be available for a limited time. With the pending FHFA credit changes (moving to a bi-merge requirement and new credit models), we will be discontinuing Credit Assure, Wayfinder and What-if Simulator on October 1, 2024. To ensure that the more than 60,000 mortgage professionals that use today’s CreditXpert tools can continue their credit optimization programs, we have a number of ways to upgrade to the new platform.

Click here to check your upgrade eligibility.

-

No. We have worked closely with credit report providers to ensure that credit data is connected to the new CreditXpert platform. To gain access to the new CreditXpert platform, you will contract directly with CreditXpert. During the upgrade process, we will work with your credit report provider(s) to ensure a smooth Onboarding to the new Platform.

Click here to check your upgrade eligibility.

-

The following credit report providers currently support the CreditXpert platform, and we are actively working with others to establish connections.

Advantage Credit, Advantage Plus Credit, Birchwood Credit Services, Certified Credit Reporting, Cisco Credit, CoreLogic Credco, Funding Suite (Covius), Credit Technology, Credit Technologies, Equifax (Coming Soon), Factual Data (Coming Soon), Informative Research (Coming Soon), KCB Credit, Lender’s One, Merchants Credit Bureau, Partners Credit, SettlementOne, Xactus

The best way to see if your credit report provider is connected to the new CreditXpert platform is to click here to check your upgrade eligibility.

-

We are focused on making it easy to offer credit optimization to EVERY borrower. To help make that easy for lenders and originators to offer, the new CreditXpert platform is priced as a monthly subscription that is tied to the number of credit reports ordered. This means that lenders and originators can generate improvement plans for EVERY borrower without having to purchase a separate plan for each borrower and plan. The new CreditXpert platform optimizes every plan against tri-bureau mid-scores (it also works on single bureau soft pulls).

Pricing is broken down into three packages – individuals, small teams, and enterprise. Within each of those packages, you can select the pricing tier that best matches the number of monthly credit reports you order. You can access pricing for individuals and small teams here or schedule a meeting with an upgrade specialist for enterprise pricing.

-

We make it easy to upgrade to the new CreditXpert platform. If you are an individual mortgage professional, you can purchase a monthly subscription starting at just $99 here. For small teams of up to 10 mortgage professionals, you can purchase a monthly subscription starting at just $549 here. If you are looking for a plan that will support more than 10 mortgage professionals or you purchase more than 250 credit reports a month, we have enterprise plans available. To learn more about enterprise plans, please schedule time with an upgrade specialist here.

-

For those wanting to upgrade to an individual or small team plan, the upgrade can be completed in as little as 3 – 5 business days. Those looking for an enterprise plan may take a bit longer given that there may be a vendor approval process that will need to be completed. That said, we are working to streamline that part of the process by making commonly requested documents and certifications available here.

-

The current CreditXpert tools offered through your credit report provider (Credit Assure, Wayfinder and What-if Simulator) will be discontinued on October 1, 2024. To ensure that the more than 60,000 mortgage professionals that use today’s CreditXpert tools can continue their credit optimization programs, we are working to get everyone upgraded by October 1, 2024.

Click here to check your upgrade eligibility.

-

Yes! We are closely following FHFA’s guidance on both bi-merge and credit scoring models. The new CreditXpert platform will be ready to support those new guidelines as soon as they are implemented.

-

CreditXpert takes security very seriously. That’s why the new CreditXpert platform is hosted on AWS’s most secure cloud infrastructure. And CreditXpert holds ISO 27001:2013 and SOC 2 Type II certificates.

For those that are wondering, ISO 27001:2013 is an international standard that provides a framework for managing and protecting an organization’s information assets. An ISO 27001:2013 certification means that an organization has been independently audited and certified to comply with the standard’s requirements for establishing, implementing, maintaining, and continually improving an information security management system. And a SOC 2 Type II report evaluates an organization’s security controls over time and provides assurance that the organization has maintained adequate security controls to protect customer data. It covers controls related to security, availability, processing integrity, confidentiality, and privacy. Click here for more details on CreditXpert’s security protocols.

-

Absolutely not! We believe that the CreditXpert platform should be used on EVERY mortgage borrower. To start with, we know that 74% of borrowers with an initial score below 780 can improve their score by AT LEAST 20-points within a 30-day timeframe. That means that nearly 3 out of every four borrowers you are working with could meaningfully improve their score. For some this will mean qualifying for a mortgage and being able to realize the dream of homeownership. For others it may mean that a higher score could get them into a better loan program, lower their interest rate and even lower their private mortgage insurance premiums. For those with credit scores above 780, showing them that you have done everything you can to provide them with the most compelling offer will build trust and increase your chances of beating out your competition and closing the loan. With the new subscription-based pricing our hope is this enables an always use model and removing the transactional bureau by bureau current model. This allows you to run CreditXpert on all credit scores to make sure you’re providing your borrower with the best possible deal.

-

This is a question we often get from lenders that are looking to leverage credit optimization. The main difference between our technology and credit repair and counseling services is that CreditXpert’s predictive analytics platform is grounded in highly sophisticated algorithms that give lenders clear insights into an applicant’s credit potential (the highest possible mid-score) along with a detailed plan on how to reach a target mid-score. These algorithms have been trained and refined over the years through the analysis of nearly 1 billion mortgage credit inquiries.

Another difference between CreditXpert’s Platform and credit repair and counseling services is that our technology delivers insights that can help applicants from across the credit spectrum improve their mid-score within in as little as 30-days. Credit repair and counseling services are dispute-based services performed by employees of a firm looking to dispute or repair questionable tradelines on behalf of a consumer for a fee. Such services often take much longer, are typically promoted to applicants on the lower end of the credit spectrum and may require the applicant to pay a monthly fee.

Secure, compliant and always on.

-

PECB MS Certified

-

AICPA SOC

-

Powered by AWS