The browser you are using is not supported. Please consider using a modern browser.

$1,089,300

The browser you are using is not supported. Please consider using a modern browser.

The most important thing you can do to get approved for the best possible rate on your mortgage is to raise your credit score.

Your credit score is one of a few things that will be considered when you apply for a home loan—however, it’s a very important factor. Other things that go into the decision are your income, debt-to-income ratio, and the loan-to-value comparison. The minimum credit score you need depends on the type of mortgage you want.

Below are the most popular types of mortgages.*

* CreditXpert has no involvement with any lender loan or pricing policies, and does not generate loan underwriting recommendations or decisions through its products or services.

Borrowers with better credit scores pay less—period. When you have a high credit score, you’ll very likely receive a lower interest rate.

If you have a 30-year loan, that could save you tens of thousands over the life of the loan. Let’s say you have a $250,000 mortgage with a 5% down payment and a 30-year term.

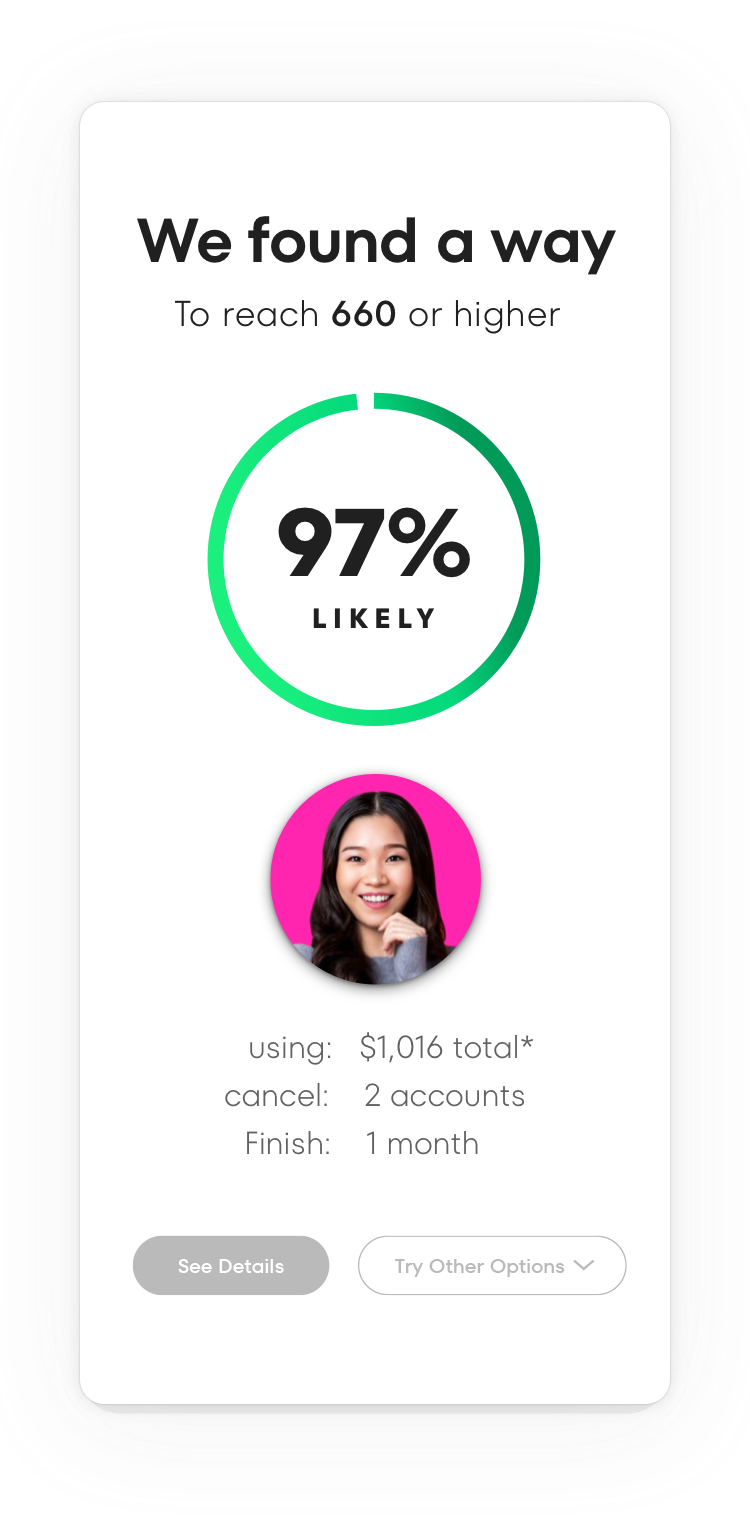

If you have a 660 credit score, your interest rate would likely be about 4.99%, and you'd pay $279,107 in total interest over the life of the loan. * These scores and rates are estimates/probabilities, and not certainties.

If your credit score increased to 740, then your interest rate could fall to about 4.375%, and you'd only pay $239,228 in total interest over the life of the loan. * These scores and rates are estimates/probabilities, and not certainties.

Credit scores seem like they are everywhere these days. Your bank or credit card company likely updates you on your credit score and there are many free sites that allow you to track your score.

But what most don’t understand is that the scores you get from your bank, or a free site are NOT the same scores your mortgage lender uses to determine whether you qualify. In fact, most find that the score they have been tracking is higher than the score their mortgage lender relies on. Regardless of what scores you have been tracking, the steps we provide could help applicants increase their scores when it actually matters– saving thousands of dollars over the life of the loan.

No! If you don’t know what you’re doing, you could likely end up hurting your credit instead of helping it.

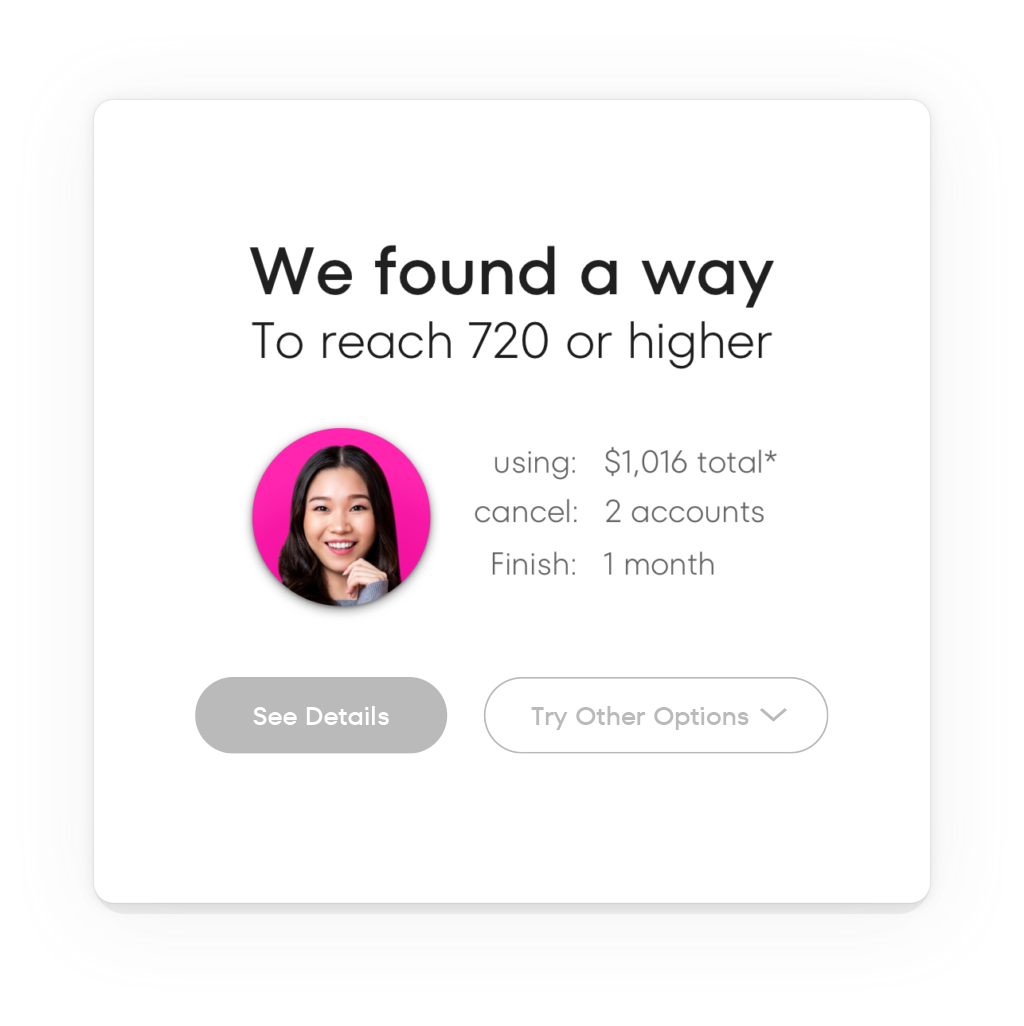

Credit scores are complicated and there’s a science to raising your credit score. Since our founding, our predictive analytics engine has processed nearly 1 billion credit records. As a result, we can help you know your potential and what it will likely take to reach a target score.

Not necessarily. Last year, we helped more than 900,000 consumers and found that 73% of applicants could improve their credit score by 20-points or more within the same 30 days it typically takes to get your mortgage to the closing table.*

* Results are based on the most recent Credit Mortgage Potential Index and the improvement potential for applicants over the last 30 days.

CreditXpert is completely different. We’re about helping every mortgage applicant achieve the highest mortgage credit score possible.

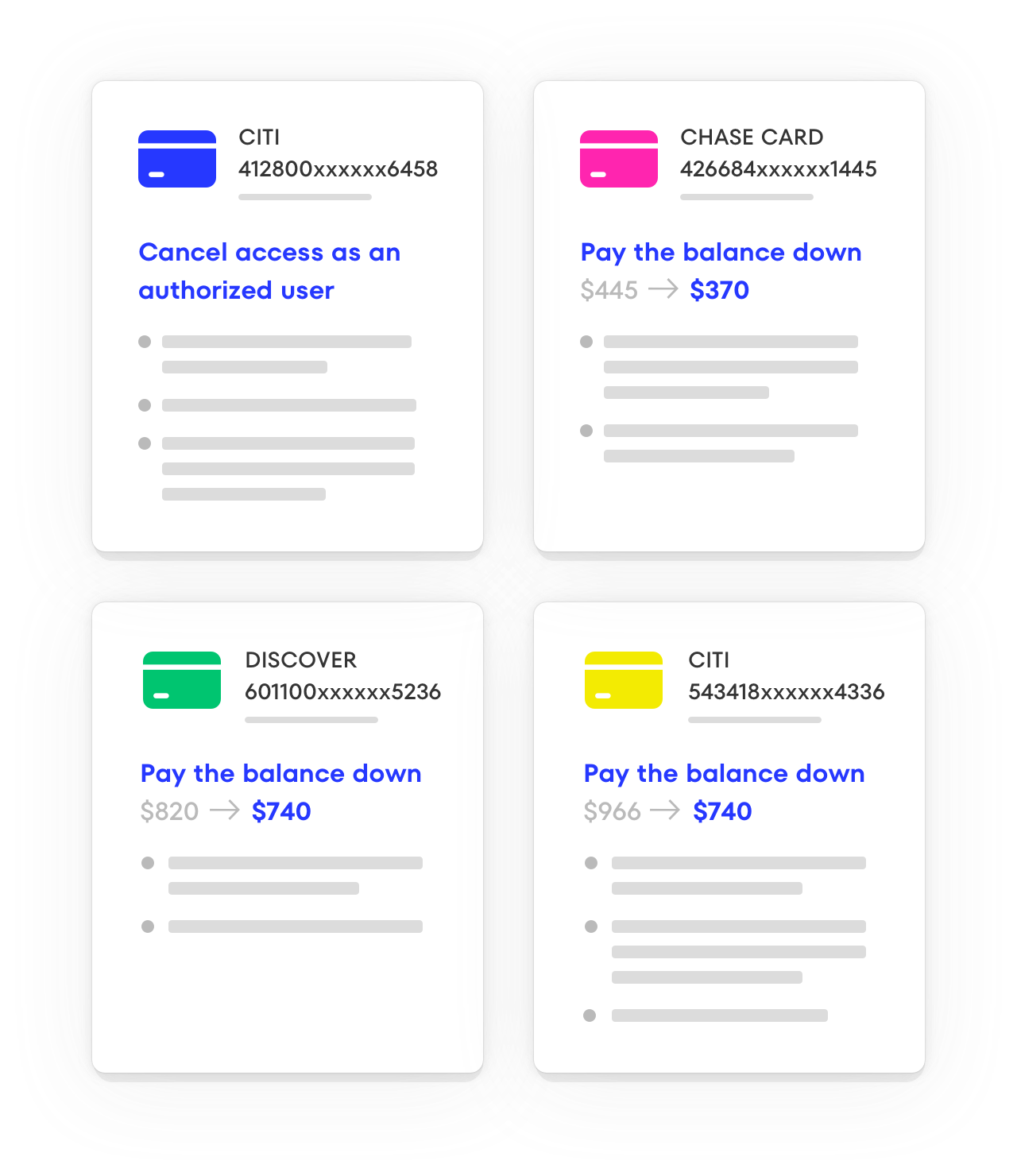

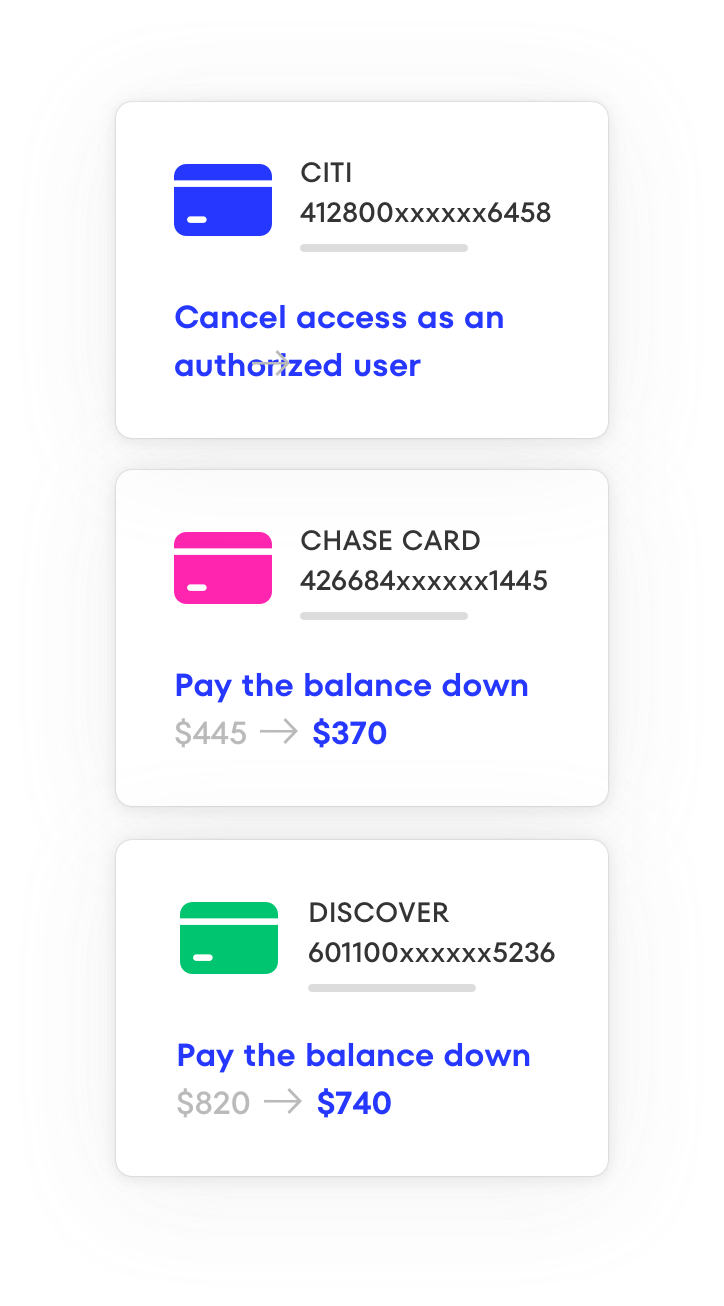

Credit repair or counseling are different, and provide assistance to consumers who need help with credit disputes or improving their overall relationship with money. CreditXpert, on the other hand, uses artificial intelligence to show you the most likely path to a higher credit score. Whether it’s paying off a loan, opening a new card, or even requesting a balance increase, we have actionable steps you can take, often in 30 days to increase your score.

Tell us what you’re looking to do and we’ll show you the potential we have identified for millions like you.

CreditXpert is not affiliated with or endorsed by Experian (EXP), TransUnion (TU), Equifax (EFX) or FICO. Unless otherwise specified, assessments of score change causation and impact, and any score change predictions are produced by CXI and not by FICO or any credit bureau.