The browser you are using is not supported. Please consider using a modern browser.

The new platform built to turn credit into a strategic growth engine

We’ve worked with innovative lenders to build a platform that utilizes credit to qualify more applicants, make better offers and close more loans.

Competitive markets call for innovative solutions.

The next generation of

credit potential is here.

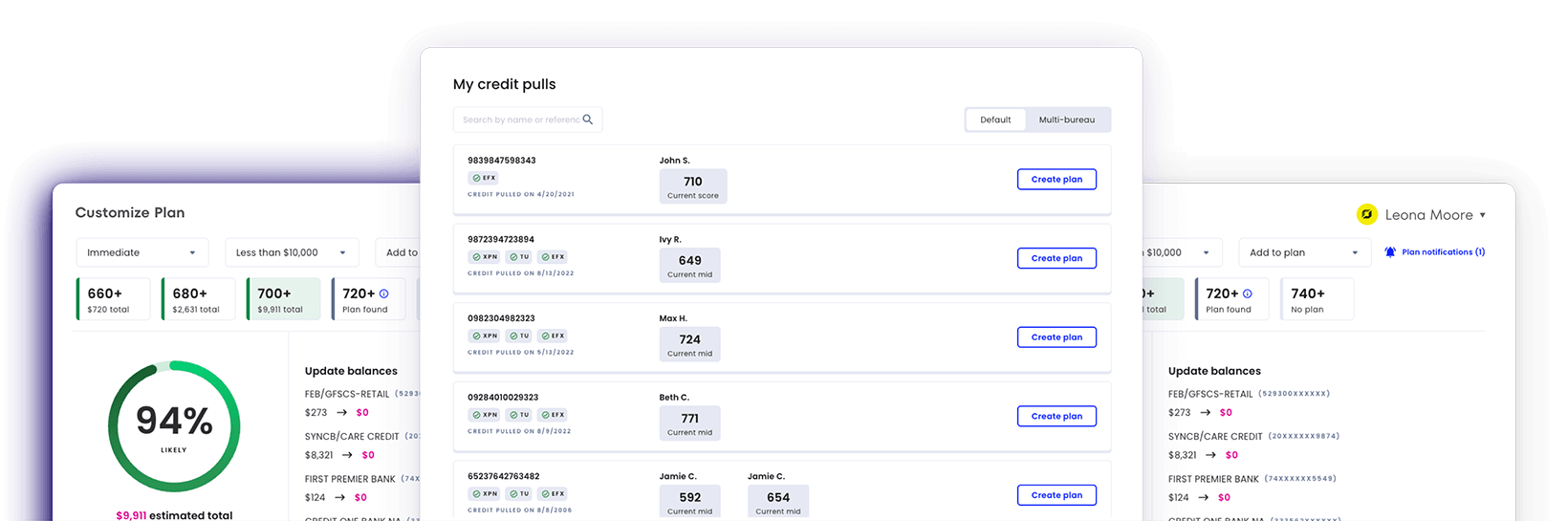

Every applicant’s credit potential right in front of you.

With 73% of applicants able to increase their score by at least 20-points within 30 days, it’s important to have quick access to everyone’s potential. Our AI quickly identifies an applicant’s mid score and a single click will show you their potential and what it will take to get there.

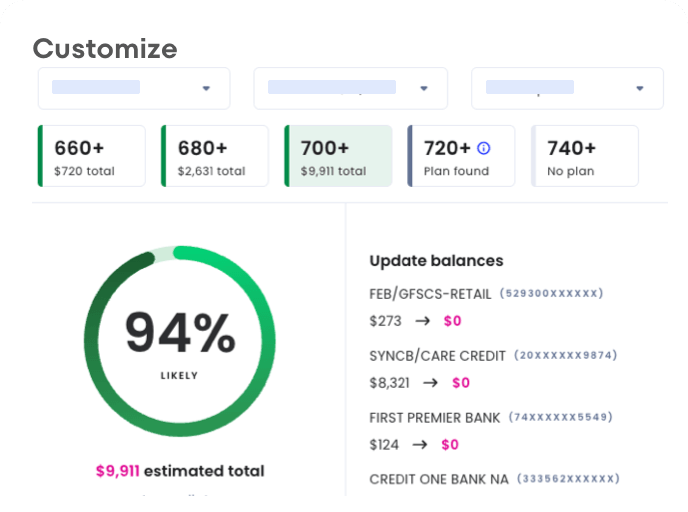

Automatically generate and compare improvement plans in real time.

Savvy homebuyers move quickly to find the lender that is going to give them the most compelling offer. Our predictive analytics engine helps you see an applicant’s credit potential, specific improvement actions and the likelihood of them reaching a target score.

Share improvement plans and track applicant progress.

Lenders need to stay laser focused on closing loans—not keeping tabs on applicants and how they are coming with their credit improvement plan. All you need to do is set a due date and share the plan. CreditXpert automatically sends reminders, tracks applicant progress and updates your dashboard. It’s that easy.

AI that helps you reduce errors and improve efficiency.

CreditXpert’s proprietary algorithms have analyzed nearly 1 billion credit records and can help identify underwriting blockers and pinpoint changes between credit pulls that may have impacted an applicant’s credit score.

Scale CreditXpert across your organization with our growing suite of enterprise-ready tools.

Today’s most innovative lenders use CreditXpert to help them attract more leads, make more competitive offers and close more loans. This means they need tools that will help them control and monitor usage, automate process, and more.

Ready to turn credit into a strategic growth platform?

Watch an on-demand demo right away or sign up for a live, interactive demo where you can ask questions and get tips on best practices.

What’s New in the Enterprise Platform?

| Prior Generation Tools |

Enterprise Platform |

|

|---|---|---|

| Credit potential alerts |

(On PDF Credit Report)

|

|

| Single bureau improvement plans |

|

|

| Multiple bureau plans over multiple time periods |

|

|

| Simulate trade-line scenarios for more challenging records |

|

|

| PDF improvement plans |

|

|

| Send interactive digital improvement plans to applicants |

|

|

| Customize improvement plans with your logo and contact information |

|

|

| Automatically track applicant progress |

|

|

| Automated follow-up with applicants |

|

|

| Underwriting blocker alerts |

|

|

| Compare changes between credit pulls |

|

|

| Manage users rights & access |

|

|

| Set-up and manage internal segments (branches, departments, regions, etc.) |

|

|

| View usage and results reports |

|

|

| Real-time cloud deployed feature and performance updates |

|

|

| Pricing |

Per Bureau / Per Use

Purchased through CRA |

Monthly Subscription

with CreditXpert Get Started |

Prior

Generation Tools

- Credit potential alerts (On PDF Credit Report)

- Single bureau improvement plans

- Simulate trade-line scenarios for more challenging records

- PDF improvement plans

- Underwriting blocker alerts

Enterprise

Platform

- Credit potential alerts

- Single bureau improvement plans

- Multiple bureau plans over multiple time periods

- Simulate trade-line scenarios for more challenging records

- PDF improvement plans

- Send interactive digital improvement plans to applicants

- Customize improvement plans with your logo and contact information

- Automatically track applicant progress

- Automated follow-up with applicants

- Underwriting blocker alerts

- Compare changes between credit pulls

- Manage users rights & access

- Set-up and manage internal segments (branches, departments, regions, etc.)

- View usage and results reports

- Real-time cloud deployed feature and performance updates

Frequently Asked Questions

-

The following credit report providers support the CreditXpert platform, and we are actively working with others to establish connections.

Advantage Credit, Advantage Plus Credit, Alliance 2020, American Reporting Company, ACRAnet CDS, ACRAnet CBS, ACRAnet Heartland, Advantage CB Inc., Birchwood Credit Services, Certified Credit Reporting, CIC Mortgage Credit, Credit Information Systems, CIS Information Services, Cisco Credit, CoreLogic Credco, Covius, Credit Data Corp, Credit Plus, Credit Technologies, DataFacts, EGS Credit Services, KB Credit, Partners Credit, Online Info Srv, SARMA, SettlementOne, United One Resources, Sharper Lending, Universal Credit.

More coming soon!

-

Existing CreditXpert users will NOT be automatically upgraded to the new platform. If you are interested in upgrading to the new platform, schedule some time with a CreditXpert specialist here to learn more about getting connected.

-

Access to the new platform is only available directly from CreditXpert. If you are interested in upgrading to the new platform, schedule some time with a CreditXpert specialist to learn more about getting connected.

-

No! CreditXpert is used by more than 60,000 mortgage loan officers today. These users include brokers, small local lenders, regional originators and national market leaders. Our platform is designed to scale to meet the needs of your specific organization. This means that a single mortgage loan originator can easily use the platform without advanced training in credit – we’ve even added automated tools to help track applicant progress as they complete an improvement plan.

That said, some of the most innovative and successful lenders have built out dedicated credit departments to help their mortgage loan officers stay focused on new applicants and closing loans.

-

Yes. CreditXpert is only available for licensed mortgage lenders.

-

This is a question we often get from lenders that are looking to leverage credit as a strategic growth engine. The main difference between our technology and credit repair and counseling services is that CreditXpert is grounded in highly sophisticated predictive analytics algorithms that give lenders clear insights into an applicant’s credit potential (the highest possible mid-score) along with a detailed plan on how to reach a target mid-score. These algorithms have been trained and refined over the years through the analysis of nearly 1 billion mortgage credit inquiries.

Another difference between CreditXpert and credit repair and counseling services is that our technology delivers insights that can help applicants from across the credit spectrum improve their mid-score within in as little as 30-days. Credit repair and counseling services often take much longer, are typically designed to help applicants on the lower end of the credit spectrum and may require the applicant to pay a monthly fee.

Click here for more on how CreditXpert differs from credit repair and credit counseling.

-

No! While we are proud to help those with initial credit scores below the minimum qualification guidelines realize the dream of homeownership, the vast majority of applicants that can be helped are those that already qualify for a mortgage. In fact, we know that 73% of those with initial scores below 760 could improve by 20-points or more within 30 days. This means that CreditXpert helps applicants qualify for more appropriate loan programs, expand their purchasing power, and lower the cost of homeownership by qualifying for a lower interest rate.

To help lenders understand how they can make the most compelling offers to their applicants, we publish our monthly Mortgage Credit Potential Index. The index sheds light on mortgage credit inquiry volume and potential score increases for each 20-point band. Download the latest version of the Mortgage Credit Potential Index here.

-

At this time, CreditXpert is only for mortgage lending as it is optimized to deliver insights on mortgage-specific FICO models.

-

The new platform is available only through CreditXpert and is offered as a monthly subscription that is based on a lender’s average number of monthly inquiries. To learn more about the new platform and subscription tiers, schedule some time with a CreditXpert specialist here.

-

Prime LendingRod’s client was eager to secure a loan for a vacation home. When Rod pulled the credit report, he noticed that the score was 698 – 18 points less than what his client saw on a free credit score site. When the client learned that this meant his rate would be a quarter of a percent higher, he was ready to walk away from both the loan and the property. Rod convinced his client to reconsider, believing he could find a way to help improve the credit score. When analyzing the credit picture, Rod saw that his client had co-signed on a furniture purchase for a family member who hadn’t yet paid it off. Using CreditXpert, Rod discovered that his client’s score would increase just enough to qualify for a better rate if he paid the balance down by $1,000. Once the client completed the action, Rod rescored him at the higher credit score and secured a lower rate – saving $37,800 over the life of the 30-year mortgage.

Prime LendingRod’s client was eager to secure a loan for a vacation home. When Rod pulled the credit report, he noticed that the score was 698 – 18 points less than what his client saw on a free credit score site. When the client learned that this meant his rate would be a quarter of a percent higher, he was ready to walk away from both the loan and the property. Rod convinced his client to reconsider, believing he could find a way to help improve the credit score. When analyzing the credit picture, Rod saw that his client had co-signed on a furniture purchase for a family member who hadn’t yet paid it off. Using CreditXpert, Rod discovered that his client’s score would increase just enough to qualify for a better rate if he paid the balance down by $1,000. Once the client completed the action, Rod rescored him at the higher credit score and secured a lower rate – saving $37,800 over the life of the 30-year mortgage.

Secure, compliant and always on.

-

ISO Certified

-

AICPA Service Organization

-

Powered by AWS